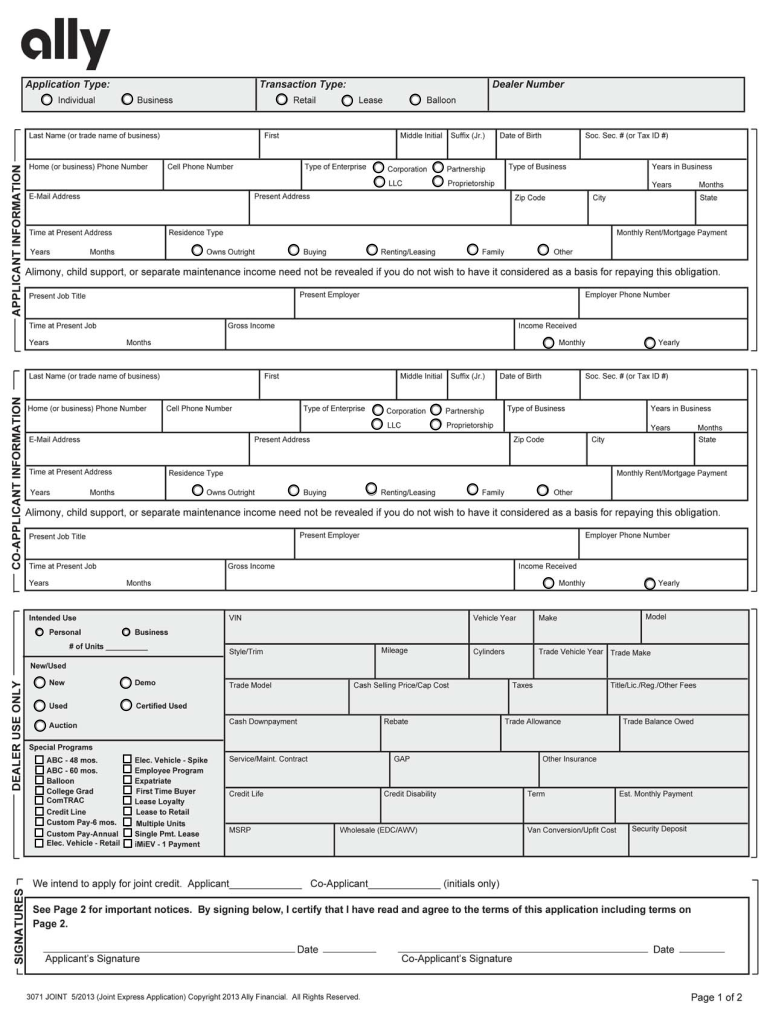

We intend to apply for joint credit. Applicant. (Io-Applicant . 3071 JOINT #2010 (Joint Express Application) Copyright 20113 Ally Financial. All Rights Fie served.

We are not affiliated with any brand or entity on this form 98,753 Reviews 11,210 Reviews 715 Reviews 789 Reviews

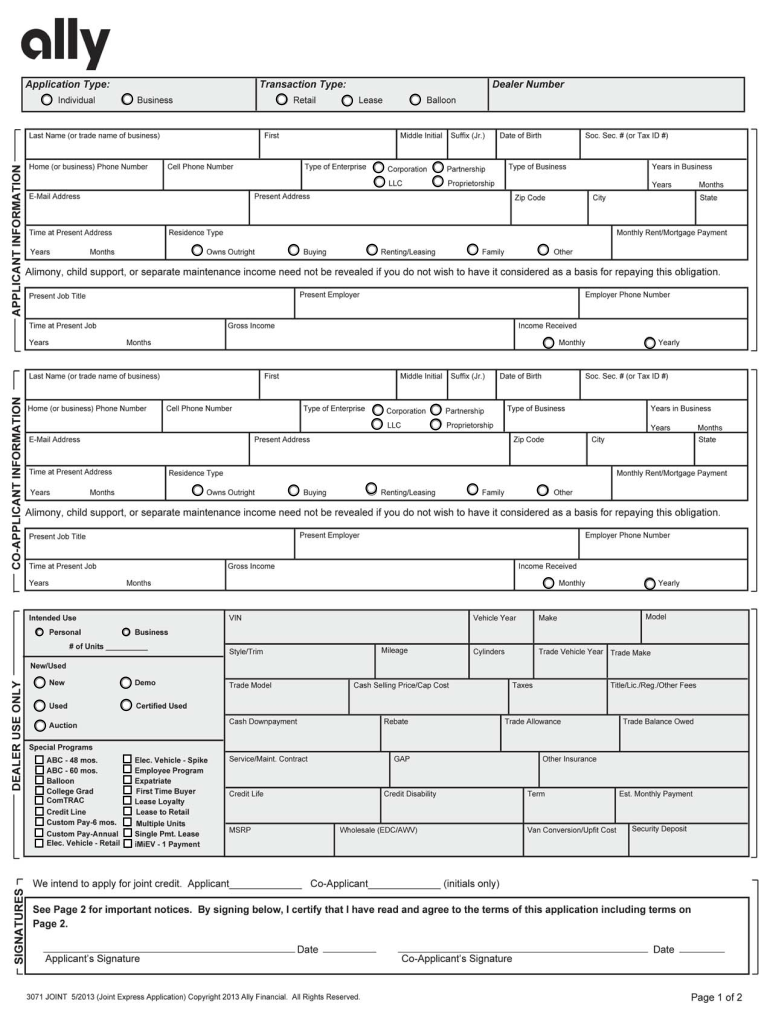

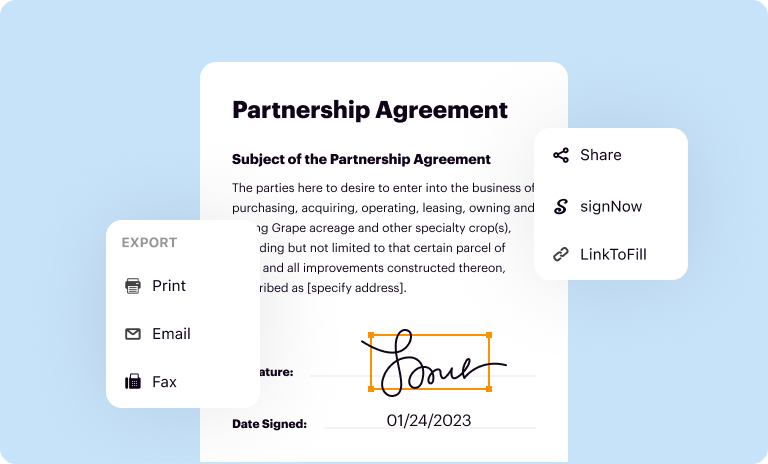

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

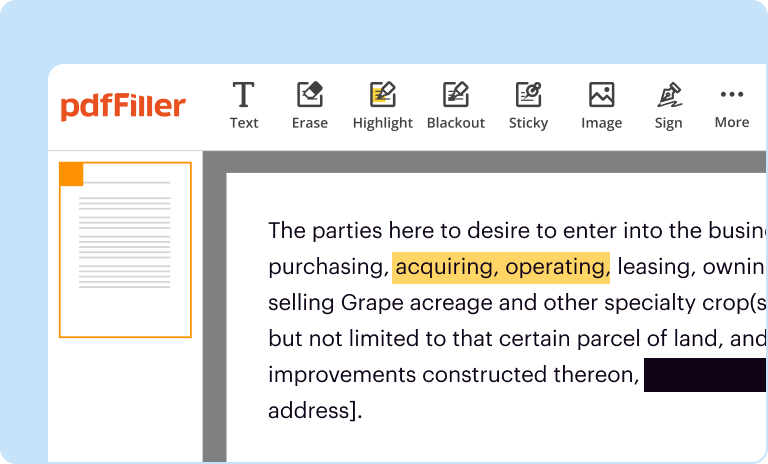

Email, fax, or share your ally credit app pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

Edit ally business credit application form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Proceed to input your employment details, including your current occupation and employer's information.

Fill in your financial details, including your income, expenses, assets, and liabilities. Choose the type of credit product you are applying for and provide the requested details. Review all the information you have provided and make sure it is accurate and complete. Submit the application online or hand it over to the Ally bank representative.What credit score do you need for an Ally Bank auto loan? You'll be eligible for better rates with a credit score of 620 or higher, but Ally has extended loan offers to consumers with credit scores as low as 520.

What credit card company does not do hard inquiry?For the purposes of this guide, I'll go through the best secured credit cards you can apply for that do not require a hard pull on your credit: OpenSky® Secured Visa® Credit Card. First Progress Platinum Prestige Mastercard® Secured Credit Card. Applied Bank® Secured Visa® Gold Preferred® Credit Card.

Does Ally credit card do a hard pull?Yes, the Ally Platinum Mastercard® does a hard pull on your credit report when you apply for the card.

What is the minimum credit score for Ally financing?Minimum credit score needed for each mortgage loan type Type of LoanMinimum FICO ScoreConventional620JumboAbove 700FHA loan requiring 3.5% down payment580FHA loan requiring 10% down payment5003 more rows • Feb 13, 2023

What credit score do you need for Ally?What Credit Score Do You Need? Ally typically requires a FICO score of at least 620. For jumbo loans, though, borrowers need a FICO score of at least 700 and a debt-to-income ratio of no more than 43%.

Does Ally Financial approve bad credit?Does Ally Financial finance bad credit? The approval of a loan through Ally Auto Finance depends on the financial institution and the participating dealership. You may be able to secure a car loan if you have bad credit, but you could end up with a high interest rate.

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ally credit application?Ally Credit Application is an online application process for Ally Bank products and services, such as auto loans, mortgages, credit cards, and more. Through the application, customers can easily apply for the product or service they need. The application will ask for personal information, such as income, credit history, and employment information. After submitting the application, a customer can expect to hear from a representative of Ally Bank regarding the application status.

Who is required to file ally credit application? Anyone who is applying for credit from a lender is required to file a credit application. What information must be reported on ally credit application?1. Personal information such as name, address, date of birth, Social Security number and contact information. 2. Financial information such as income, employment and bank account information. 3. Credit information such as current creditors, account balances and payment history. 4. Collateral information such as vehicle descriptions and values. 5. Other information such as co-applicant information, references, and authorization to obtain a credit report.

When is the deadline to file ally credit application in 2023?The deadline to file any credit application in 2023 is dependent on the individual lender and their specific requirements. It is best to check with the lender directly to find out the specific deadline.

What is the penalty for the late filing of ally credit application?The penalty for the late filing of an ally credit application will depend on the specific terms of the application, as well as any related agreements. In some cases, there may be no penalty at all. However, if there are any late fees associated with the application, they must be paid before the application can be approved.

How to fill out ally credit application?To fill out an Ally credit application, you will need to follow these steps: 1. Visit the Ally website: Go to the official website of Ally and locate the credit application section. It is typically found under the "Banking" or "Lending" category. 2. Click on "Apply Now" or similar: Once you've located the credit application section, click on the "Apply Now" button or a similar option to begin the application process. 3. Create an account or sign in: If you already have an Ally account, sign in with your username and password. If not, click on the option to create a new account to proceed with the application. 4. Provide personal information: Fill in your personal information, including your full name, date of birth, address, phone number, and email address. Ensure that all the entered information is accurate. 5. Employment details: Provide information about your current employment, including your employer's name, your job title, and your monthly income. You may also be required to enter details of your previous employment if applicable. 6. Financial details: Enter information regarding your financial situation, including your total annual income, monthly housing payments, and any additional sources of income or financial assets. 7. Review and submit: Before submitting your application, carefully review all the information you have entered to make sure it is correct. Once you are confident that everything is accurate, submit the application. 8. Await approval: After submission, the Ally team will review your application and determine whether or not to approve your credit. This may take a few days, so be patient during the process. Note: The specific steps and format of the application may vary slightly depending on the version of Ally's website and the type of credit you are applying for.

What is the purpose of ally credit application?The purpose of an Ally credit application is to apply for a credit account with Ally, a financial services company. By submitting this application, individuals can request to establish a line of credit with Ally, which can be used for various purposes such as making purchases, accessing loans, or building credit history. The application collects necessary personal and financial information to evaluate the applicant's creditworthiness and eligibility for an Ally credit account.

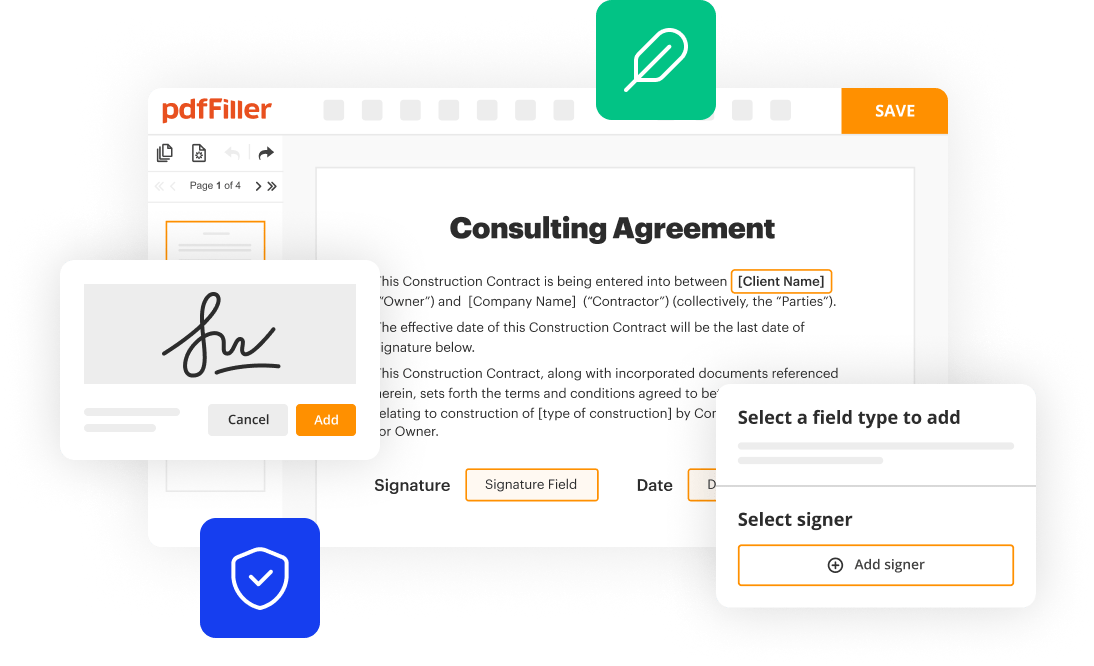

How do I make changes in ally credit application?The editing procedure is simple with pdfFiller. Open your ally business credit application form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

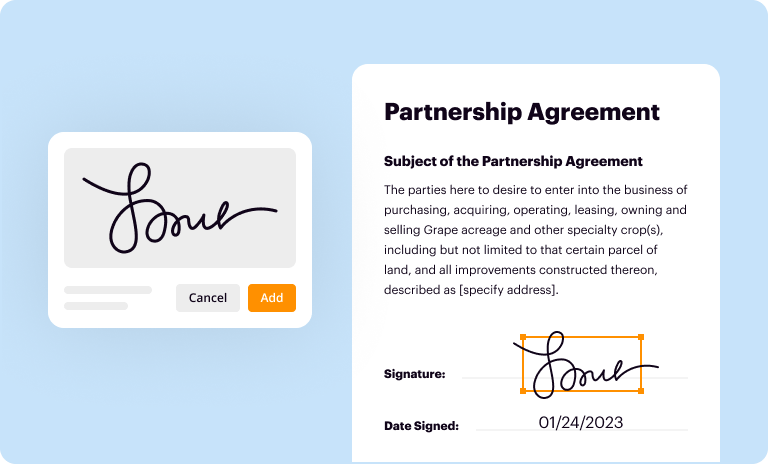

How do I fill out the ally credit application pdf form on my smartphone?On your mobile device, use the pdfFiller mobile app to complete and sign ally credit app pdf. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit ally credit app on an iOS device?Use the pdfFiller app for iOS to make, edit, and share ally financial credit application form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.